* A Distributed Proofreaders Canada eBook *

This eBook is made available at no cost and with very few restrictions. These restrictions apply only if (1) you make a change in the eBook (other than alteration for different display devices), or (2) you are making commercial use of the eBook. If either of these conditions applies, please contact a https://www.fadedpage.com administrator before proceeding. Thousands more FREE eBooks are available at https://www.fadedpage.com.

This work is in the Canadian public domain, but may be under copyright in some countries. If you live outside Canada, check your country's copyright laws. IF THE BOOK IS UNDER COPYRIGHT IN YOUR COUNTRY, DO NOT DOWNLOAD OR REDISTRIBUTE THIS FILE.

Title: Social Credit

Date of first publication: 1935

Author: C. H. (Clifford Hugh) Douglas (1879-1952)

Date first posted: May 13, 2023

Date last updated: May 13, 2023

Faded Page eBook #20230526

This eBook was produced by: Marcia Brooks, Howard Ross & the online Distributed Proofreaders Canada team at https://www.pgdpcanada.net

BY THE SAME AUTHOR

Credit-Power and Democracy.—Crown 8vo. 7s. 6d. net.

Economic Democracy.—Crown 8vo. 6s. net. 4th edition.

Control and Distribution of Production.—Crown 8vo. 7s. 6d. net.

These Present Discontents and the Labour Party.—Crown 8vo. 1s. net.

The New and the Old Economics.—Crown 8vo. 1s. net.

The Monopoly of Credit.—Crown 8vo. 3s. 6d. net

Warning Democracy.—Crown 8vo. 7s. 6d. net.

“Major Douglas’s proposals have for some months occupied an important place among the various plans put forward to counter the economic crisis through which the country is passing. It is indeed possible that before many months have passed we may see them proposed. It would surely be a good thing, therefore, in a country that prides itself upon being a democracy, that such ideas as these should be canvassed publicly and some definite opinion formed on them.”—THE TIMES.

SOCIAL CREDIT

BY

C. H. DOUGLAS

M.INST.MECH.E., AUTHOR OF “CREDIT POWER AND DEMOCRACY,” “ECONOMIC DEMOCRACY,” ETC.

Third edition, revised and enlarged

1935

EYRE & SPOTTISWOODE

LONDON

First edition, 1924

Second edition, 1926

Third (revised and enlarged) edition, May 1933

Reprinted July 1933

Reprinted April 1934

Reprinted 1935

Made and Printed in England for

Eyre and Spottiswoode (Publishers) Ltd.

The first edition of this book was issued in 1924 in order to correlate the financial theories, which have since become widely known under the same title, with the social, industrial, and philosophic ideals to which they are appropriate.

At the time that it first appeared (in 1924), it was generally assumed that the world was entering upon a period of increasing prosperity, and such prosperity in a material sense did accrue in the United States to an extent never previously experienced.

It will be noticed that the view that this prosperity could be of long duration was not held to be consistent with the theories of Social Credit, so long as the conditions imposed by the existing financial system remained unchanged, and it was suggested that such prosperity would be followed by a crisis of the first magnitude. The same views were expressed in a long cross-examination before the select Committee of the Canadian House of Commons on Banking and Industry in 1923, and have unfortunately proved to be only too well founded. The pressure of the world crisis, and the fear that it may develop into forms threatening the extinction of civilisation, have brought home to large numbers of people in every country the instant necessity of finding an explanation of the paradox of poverty amidst plenty, with its accompaniment of social and political stress and strain, as well as the urgency of a remedy.

In every country of the world, and more particularly in the British Dominions overseas, the financial system has been brought to the Bar of Public Opinion as the chief factor in world unrest, and there is little doubt that the Jury has confirmed the Verdict somewhat rhetorically expressed by Mr. William Jennings Bryan in his famous election speech: “The money power preys upon the nation in times of peace, and conspires against it in times of adversity. It is more despotic than monarchy, more insolent than autocracy, more selfish than bureaucracy. It denounces, as public enemies, all who question its methods, or throw light upon its crimes. It can only be overthrown by the awakened conscience of the nation.”

The present edition of the book has been completely revised, and new matter has been added to amplify the meaning it was intended to convey, but the main thesis remains substantially unaltered as a result of the confirmation which events have supplied as to its essential soundness.

C. H. DOUGLAS.

Temple,

May 1933.

There is an ancient saying (which will bear consideration in these days of change and unrest) that the devil is God upside down. A consideration of many of the injurious and tyrannical practices which obtain support in Great Britain and America under the cloak of such words as Justice and Democracy, and the object lesson provided by Russia, and possibly by Italy and Spain as the consequences of their extension, may serve to emphasise the necessity for clear thinking in this matter.

In the following pages an endeavour has been made to indicate the general lines which, it would appear, are essential in dealing not only with the concrete problems, but the perverted psychology which, in combination, threaten civilisation.

C. H. DOUGLAS.

Temple,

January 1924.

| PART I | ||

| CHAPTER | PAGE | |

| I. | Static and Dynamic Sociology | 4 |

| II. | Industry—Government or Service? | 14 |

| III. | The Relation of the Group to the Individual | 24 |

| IV. | Freedom of Association | 34 |

| V. | Sabotage and the Cultural Heritage | 44 |

| VI. | The Theory of the Supreme State | 52 |

| VII. | The Nature of Money | 60 |

| VIII. | The Coming of Power | 66 |

| PART II | ||

| I. | The Working of the Money System | 78 |

| II. | The Nature of Price | 94 |

| III. | Unemployment—or Leisure? | 108 |

| IV. | Poverty amidst Plenty | 120 |

| V. | Why Taxation is Heavy | 130 |

| VI. | Taxation and Servitude | 146 |

| VII. | The Bid for World Power | 156 |

| PART III | ||

| I. | The Strategy of Reform | 168 |

| II. | Sound Money | 180 |

| III. | The Critical Moment | 196 |

| APPENDIX | ||

| The Draft Scheme for Scotland | 205 | |

PART I

PHILOSOPHY

CHAPTER I

We have in England, probably to a greater extent than elsewhere, two distinct systems of education flourishing side by side. The distinction is clearly marked in the public schools and universities; but it is traceable through every grade of educational institution by the arrangements which are made to prepare candidates for public and other examinations. These two systems in the Public Schools are the Classical and the Modern sides, and have their equivalent Triposes and Honours Schools in the universities. One of these systems is Aristotelean, the second is Baconian.

Now, it does not seem to be so clearly realised as it should be, that these two systems of education are, considered separately, incompatible. The classical system is the embodiment of an attractive and artistic ideal or conception of the nature of society, and the conditions under which society lives, moves, and has its being. It is above, outside, possibly in advance of, facts. The modern school, of which inductive natural science, based upon the experimental ascertainment of fact, is the backbone, has not essentially to do with ideals at all. It is realistic; its first postulate is that forces act in a similar manner when placed in a similar relation to each other. It refuses to admit, as a fact, anything which cannot be demonstrated, and as a theory, anything which does not fit the facts. For example, the classical ideal contends that men “ought” to be good, brave and virtuous. The modern, that it does not understand the meaning of goodness, that bravery and virtue are not capable of exact definition, and, that so far as the word “ought” has any meaning, it postulates the existence of a force so far undemonstrated.

It will be recognised on a moderate consideration, that the effect on the everyday world of these two philosophies cannot fail to be disruptive. The logical outcome of the classical ideal is to lay the emphasis of any observed defects in the social organisation on defects in the characters of the persons composing the society. Wars occur because people are wicked, poverty, because people are idle, crime, because they are immoral. Material progress, which in its essence is applied Science, is repulsive to the Classical mind, because it does, in fact, stultify the rigid Classical ideal. Conversely, the scientific attitude tends to the opposite extreme, towards what is called Determinism; that people’s actions, thoughts, and morals, are the outcome of more or less blind forces to which they are subjected, and in regard to which, both censure and praise are equally out of place.

It is probable that, as in many controversies, there is a good deal to be said for both points of view, but it is even more probable that approximate truth lies in appreciation of the fact that neither conception is useful without the other. It is probable that in the less fortunately situated strata of society, a theory of economic Determinism would be a sound and accurate explanation for the actions of 98 per cent of the persons to whom it might be applied; that those persons are, in fact, obliged to act and think in accordance with limitations which are imposed upon them by their environment. In short, that their environment is more powerful in shaping them, than they are in shaping their environment. But this is not true of their more fortunate contemporaries. There are, without a doubt, circumstances in the world, in which the personal conceptions of individuals can have powerful and far-reaching consequences on their immediate and even national or continental environment. It seems reasonable to believe that a Napoleon, a Washington, or a Bismarck have, in effect, changed the course of history, just as it is certain that a James Watt, a George Stephenson, or a Faraday, have altered the centre of gravity of industrial and economic society.

All this is sufficiently obvious, but the important idea to be drawn from it, is that before human ideals (including the Classical and religious ideals) can be brought into any effective relationship with and control by the great mass of the population, that population must be released from the undue pressure of economic forces. It is quite arguable that Napoleon was a curse to Europe, but it is not reasonably arguable that a Napoleon, if living at this time, would be sure to repeat the history of the late eighteenth and early nineteenth centuries. It is reasonably arguable also, that no man could reproduce the career of Napoleon or Bismarck in a country in which the majority of the inhabitants were both economically independent, and politically contented.

A clear understanding of the circumstances in which personality is of importance in effecting environment, and, on the other hand, the circumstances in which it is unreasonable to expect the development of personality which may be considered satisfactory in a pragmatic sense is of the first importance to a balanced consideration of the difficulties and dangers which beset the civilised world at the present time, as well as to the framing of proposals to meet the situation. No one, having devoted any consideration to the subject, can fail to feel exasperation at the exhortations of the sentimentalist forever clamouring after a “change of heart.” What effect on his particular difficulties is it going to have, if the miner, abandoning self-interest, goes to his employer and offers to accept half his present wages? Or the mine-owner, faced with a loss, who raises his men’s wages? What effect on the dividends of the shopkeeper already in debt to his bank, and in doubt as to the source from which he shall pay his next week’s rent, and meet the difference on his overdraft, does it have, if smitten with the sudden desire to apply the golden rule to business, he sells his goods at half their cost to him, because he knows his clientele, who are coal-miners, cannot afford more; thus accelerating his progress to the bankruptcy court and the cessation of his activities as a distributor? What is the use of epileptic addresses on the criminality of war, when the enemies’ aeroplanes, if not stopped, propose dropping poison gas-bombs on a population which has, probably, not the faintest understanding of the casus belli.

On the other hand, no one who has attempted to obtain a hearing for concrete proposals of a social nature from persons who seemed from their position in the world to be favourably situated in respect of their furtherance, can fail to have realised that a difficulty is always met with, in establishing a common point of view; that in fact, it is a condition of executive position-holding, that the point of view shall be in the highest degree, and in the narrowest sense, conservative. It is not an unfair description of the situation to say that those persons who in the main are anxious for changes in the social structure are powerless to effect them, while persons more favourably situated to bring them about, are rarely anxious to do so. There is not much difference in the “heart” of the two descriptions of person; the difference in behaviour arises from the fact that one is reasonably satisfied with his lot, the other is not.

This is not an abstract problem, it is a practical problem of the first importance. It can be stated in general terms as the problem of bringing together of desire and the means of fulfilment, in relation to the largest possible number of individuals. At every step it is complicated in the practical world by the interjection of so-called moral issues. The courageous bishop who stated that he would rather see England free than sober, may, or may not, have realised that he was postulating in an attractive form, an issue which challenges the idea that a good end can excuse a bad means. The same issue is raised by the endeavour (a successful endeavour), to exhibit “unemployment” as a symptom of industrial breakdown, rather than, as it should be, a sign of economic progress.

Closely interwoven with the classical and moral theory of society, is the theory of rewards and punishments. So familiar is this idea, through education and experience, to most people, that it is only with some difficulty that they are brought to realise that it is an artificial theory and not inherent in the nature of things; that the statement “be good and you will be happy” does not rely for any truth it may possess on any fixed relation between the abstract qualities of goodness and happiness, but upon the fixed relation of cause and effect between certain actions to which the title “goodness” may arbitrarily be applied, and their reactions which we term “happiness.” This may appear to be word splitting, but when we realise that the whole of the industrial, legal, and social system of the world rests for its sanctions on this theory of rewards and punishments, it is difficult to deny the importance of an exact comprehension of it.

For instance, the industrial unrest which is disrupting the world at the present time, can be traced without difficulty to an increasing dissatisfaction with the results of the productive and distributing systems. Not only do people want more goods and more leisure, and less regimentation, but they are increasingly convinced that it is not anything inherent in the physical world which prevents them from attaining their desires; yet captains of industry favourably situated for the purpose of estimating the facts, are almost unanimous in demanding a moral basis for the claim put forward. That is to say, those persons whose activities at the present time are chiefly concerned with restricting the output of the economic machine to its lowest limit, while yet asking each individual to produce more, are determined that not even the over-spill of production shall get into the hands of a semi-indigent population, without some equivalent of what is called work, even though the work may still further complicate the problem with which these industrial leaders are concerned. Nor is it fair to say that this attitude is confined to the employing classes. Labour leaders are eloquent on the subject, and with reason. The theory of rewards and punishments is the foundation stone of the Labour leaders’ platform, just as it is of the employer whom he claims to oppose. The only difference is in respect of the magnitude and award of the prizes and as to the rules of the competition for them. To any one who will examine the subject carefully and dispassionately it must be evident that Marxian Socialism is an extension to its logical conclusion, of the theory of modern business.

CHAPTER II

The practical difference between the theory of rewards and punishments, and the modern scientific conception of cause and effect, can be simply stated. The latter works automatically, and the former does not. If I place my bare finger upon a red-hot bar, so far as science is aware, I shall be burnt, whether I am a saint or a pickpocket. That is the Modernist view. It is not so many hundred years ago since the Classical view held that I should only be burnt if I were a pickpocket or similar malefactor; and ordeal by fire was a ceremony conducted on this theory. It is alleged in select circles even yet, that it is possible to be so saintly, that fire loses its power over the human flesh. But a manufacturer of rolled steel rails, who laid out his factory on the assumption that it would be possible to hire enough saints to handle his white-hot product without apparatus other than saintliness, would undoubtedly experience labour trouble.

That is the point. It is not necessary to have a contempt, or to be lacking in a proper respect, for qualities in human beings which add to the grace, dignity and meaning of human existence, to be quite clear that those qualities are not in themselves at issue in regard to many of the economic and industrial problems which confront the world at this time.

No one would contend in so many words, that the efficiency of the modern factory or farm, considered as a producing mechanism, is seriously handicapped by the lack of moral qualities in those employed. It is a familiar suggestion, brought forward for the consumption of a mystified and uninformed public that, e.g. “Ca’ Canny” methods, Trade Union rules, and idle workers, are responsible for trade depression, but only sentimentalists and middle-men out of touch with production, pay serious attention to the idea. Such practices may complicate the general question, and their existence does enable the real causes to be masked in a babel of recrimination. At the present time, however, there is not a manufacturer of any consequence who would not feel himself capable of obtaining almost any output required of him, provided that all restrictions of price and cost were removed; or to put the matter as shortly as possible, the difficulties with which the modern employer is confronted are not difficulties of production, they are difficulties in respect to the terms of the contract to which he himself, his employees and the purchasing public are all parties. If, therefore, a majority of persons so placed that they are in a position to impose their will on the remainder of the world, are determined to run the whole producing system of the world as a form of government, it is certainly not yet proven that they cannot do it. But it certainly is already clearly proven that they cannot, at one and the same time, make the producing and distributing systems a vehicle for the government of individuals by the imposition of rewards and punishments, which involves arbitrary restrictions on the distribution of the product, and at the same time be the most efficient and frictionless machine for the production and delivery of the maximum amount of goods and services with the minimum expenditure of time and labour on the part of those concerned in the operation. That is indisputable.

So far as this matter is ever discussed dispassionately, the argument is apt to proceed in a vicious circle. In the face of the patent and growing difficulty of finding employment in ordinary economic avocations for those who at present cannot live without it, it is claimed that the introduction of any method by which the unemployed could live, i.e. be “rewarded” without being employed, besides being immoral, “demoralises them,” i.e. renders them unsuitable for subsequent employment. Disregarding for the moment the circular nature of this argument, it is curious to notice how generally it is accepted in the face of a good deal of evidence to the contrary, and little evidence in support of it. It is notorious that some of the most successful and useful members of the community during the times of stress between 1914 and 1919, were young men and women of whom nothing but the worst was prophesied during their idle years which immediately preceded the war. It is true, nevertheless, that it is difficult to induce persons who have once enjoyed the expanding influences of increased freedom of initiative, to return to long hours of mechanical drudgery, offering no prospect of improvement or release, and it is not unfair to say that numbers of employers of a somewhat narrow outlook have this fact at the back of their minds when they bewail the demoralising influences which have been brought to bear upon their employees during the last decade.

It is evident then that, before any solution to all these problems of world unrest can be put forward with any certainty of success, it is necessary to come to some understanding on matters of fact.

The primary fact on which to be clear is that we can produce at this moment, goods and services at a rate very considerably greater than the possible rate of consumption of the world, and this production and delivery of goods and services can, under favourable circumstances, be achieved by the employment of not more than 25 per cent of the available labour, working, let us say, seven hours a day. It is also a fact that the introduction of a horse-power-hour of energy into the productive process could, under favourable circumstances, displace at least ten man-hours. It is a fact that the amount of mechanical energy available for productive purposes is only a small fraction of what it could be. It seems, therefore, an unassailable deduction from these facts that for a given programme of production, the amount of man-hours required could be rapidly decreased, or conversely, the programme could be increased with the same man-hours of work, or any desired combination of these two could be arranged. But it is also a fact that, for a given programme, increased production per man-hour means decreased employment. It is also a fact, that never during the past few decades have we been free from an unemployment problem, and it is also a fact that never during the past fifty years has any industrial country been able to buy its own production with the wages, salaries, and dividends available for that purpose, and in consequence, all industrial countries have been forced to find export markets for their goods.

So that we are confronted with what seems to be a definite alternative. We can say, as we are saying up to the present time, that the wages, salaries, and dividends system, with its corollaries of the employment system, as at present understood, and the moral discipline which is interwoven with all those things, is our prime objective. Having decided that, we have decided that the industrial system with its banks, factories, and transportation systems, exists for a moral end, and does not exist for the reason which induces individuals to co-operate in it, i.e. their need for goods; and that moral end can only be achieved through the agency of the system and its prime constituent—employment. And the practical policy to be pursued is one which has been frequently pointed out from diverse sources, and which was the basis, or alleged basis, of the Russian Revolution. It is to make the man-hours necessary for a given programme of production equal to the man-hours of the whole population of the world, so that every one capable of any sort of work should, by some powerful organisation, be set working for eight or any other suitable number of hours a day. To achieve this end, the use of labour-saving machinery should be discouraged, all scientific effort should be removed from industry (as was at first done in Russia), and, in particular, modern tools, processes, and the application to industry of solar energy in its various forms should be vigorously suppressed. Failing an alternative, one should dig holes and fill them up again. All this is the logical outcome of the attitude, not merely of the orthodox employer (although he may not realise it), but of the orthodox socialist, and it ought to be clearly recognised. The world has not yet passed a deliberate verdict on the matter, and it ought to have the case and the evidence; and in the meantime the atmosphere of war and economic catastrophe in which the world is enveloped, should be accepted as a desirable means towards a high moral objective.

The other alternative, while recognising the necessity for discipline in the world, does not concern itself with that necessity in considering the modern productive process. It surveys the facts, finds an inherent incompatibility between the substitution of solar energy for human energy, on the one hand, and the retention of a financial and industrial system based on the assumption that work is the only claim to goods, on the other hand, and takes as its objective the delivery of goods, making the objective always subordinate to human individuality. It is not concerned with abstractions, such as justice. It has no comment to make on the fact that one man does twice as much work as another, except to enquire whether he likes doing it; or that one man wants twice as much goods as another, except to investigate the difficulties, if any, in giving them to him. It observes, or thinks it observes, that it has sufficient data to predict not only that such a policy would work, but that it is the only policy in sight which would work.

The vast majority of discussions which take place in regard to industrial problems are prevented from arriving at any conclusion from the fact that the disputants do not realise the premises on which their arguments are based, and in many cases use words (and “justice” is an example of such words) which beg the whole question at issue. It is not too much to say that one of the root ideas through which Christianity comes into conflict with the conceptions of the Old Testament and the ideals of the pre-Christian era, is in respect of this dethronement of abstractionism. That is the issue which is posed by the Doctrine of the Incarnation.

CHAPTER III

We live so close to a world shot through with the theory of rewards and punishments that the relation between the system and its results is apt to escape us. We are told for instance, with all the emphasis which can be given to the assertion by the prestige of names much in the public eye, that our present distress arises because we are a poor nation as the result of a great war. The idea inherent in this is that war is wicked, poverty is painful, and wicked people who went to war ought to endure pain, and, therefore, we ought to be poor. And because of this logical morality the idea is accepted almost unquestioningly by millions of people who only have to use their eyes to see the patent absurdity of it. Is there a manufacturer in this country, or for that matter in any other, who is not clamouring to turn out more goods if someone will give him orders for them? Is there a farmer who is complaining that his land and his stock are unable to cope with the demands for agricultural produce which pour in upon him? If so, an explanation as to why nearly three million acres of arable land have gone back to pasture in the last twelve years, would be interesting.

On the other hand, it is patent that, in spite of this enormous actual and potential reservoir of the goods for which mankind has a use, a large proportion of the population is unable to get at them. What is it, then, which stands in between this enormous reservoir of supply and the increasing clamour of the multitudes, able to voice, but unable to satisfy their demand? The answer is so short as to be almost banal. It is Money. And as we shall see, the position into which money and the methods by which it is controlled and manipulated have brought the world, arises, not from any defect or vice inseparable from money (which is probably one of the most marvellous and perfect agencies for enabling co-operation, that the world has ever conceived), but because of the subordination of this powerful tool to the objective of what it is not unfair to call a hidden government.

Now it is impossible to conceive (in spite of a good deal of cynicism to the contrary) of a government which has not a policy, although that policy may be far from apparent. The conception of government postulates that certain lines of action and conduct shall be inhibited, and that the persons governed shall be allowed to proceed only in some predetermined direction. In other words, government is limitation, and from the nature of the limitations it is possible to determine the policy of the organisation imposing the limitations. For instance, while it is true enough to say that extensive military preparations do not necessarily mean war, the qualification implied in this statement is that the main threat which such preparations constitute will be sufficient to achieve the desired result without the actual use of military force. The military preparations impose a limit on action in certain directions, and then become indications, and often valuable indications, of the policy of nations.

Similarly, if we consider dispassionately the situation to which reference has just been made (a world which is either actually or potentially overflowing with material riches, and, at the same time, a population which is prevented from obtaining them by a set of rules supported by every possible device that legal organisation can devise), we can say that we are in the presence of an effective and active government, irrespective of the source of that government; and that government must have a policy. For our immediate purpose, it is nearly irrelevant whether that policy is a conscious policy, in the sense of having been put into a clear and logical form by some body of men, however small, or whether it is unconscious in the sense that it is the outcome of something we call human nature. The important matter is to get a clear conception of what the policy is as a first step to supporting or opposing it, if it is agreed that we have any measure of self-government, or ought to have any.

One of the first facts to be observed as part of the social ideal which leans for its sanctions on rewards and punishments, is the elevation of the group ideal and the minimising of individuality, i.e. the treatment of individuality as subordinate to, e.g. nationality. The manifestations of this idea are almost endless. We have the national idea, the class or international idea, the identification of the individual with the race, the school, the regiment, the profession, and so forth. There is probably no more subtle and elusive subject than the consideration of the exact relation of the group in all these and countless other forms, to the individuals who compose the groups. But as far as it is possible to sum the matter up, the general problem seems to be involved in a decision as to whether the individual should be sacrificed to the group or whether the fruits of group activity should be always at the disposal of the individual. If we consider this problem in connection with the industrial and economic situation, it is quite incontestable that every condition tending to subordinate the individual to the group is, at the moment, fostered. Institutions which would appear to have nothing in common and to be, in fact, violently opposed, can be seen on closer investigation to have this idea in common, and to that extent to have no fundamental antagonism. Pre-war Germany was always exhibited as being reactionary, feudal, and militaristic to an extent unequalled by any other great power. Post-war Russia is supposed by large masses of discontented workers, to be the antithesis of all this. But the similarity of the two is daily becoming more apparent and it is notorious that the leaders of pre-war Germany are flocking to post-war Russia in increasing numbers, in the lively hope of the fulfilment of the ideals which were frustrated by the Great War. The latest pronouncements on industrial affairs by Russian statesmen are indistinguishable from those of American, German, or British bankers (which statement is not intended as undiluted praise). It is significant that the arguments voiced from all of these quarters are invariably appeals to mob psychology—“Europe must be saved,” “Workers of the World unite,” etc. The appeal is away from the conscious-reasoning individual, to the unconscious herd instinct. And the “interests” to be saved, require mobs, not individuals.

No consideration of this subject would be complete without recognising the bearing upon it of what is known as the Jewish Question; a question rendered doubly difficult by the conspiracy of silence which surrounds it. At the moment it can only be pointed out that the theory of rewards and punishments is Mosaic in origin; that finance and law derive their main inspiration from the same source, and that countries such as pre-war Germany and post-war Russia, which exhibit the logical consequences of unchecked collectivism, have done so under the direct influence of Jewish leaders. Of the Jews themselves, it may be said that they exhibit the race-consciousness idea to an extent unapproached elsewhere, and it is fair to say that their success in many walks of life is primarily due to their adaptation to an environment which has been moulded in conformity with their own ideal. That is as far as it seems useful to go, and there may be a great deal to be said on the other side. It has not yet, I think, been said in such a way as to dispose of the suggestion, which need not necessarily be an offensive suggestion, that the Jews are the protagonists of collectivism in all its forms, whether it is camouflaged under the name of Socialism, Fabianism, or “big business,” and that the opponents of collectivism must look to the Jews for an answer to the indictment of the theory itself. It should in any case be emphasised that it is the Jews as a group, and not as individuals, who are on trial, and that the remedy, if one is required, is to break up the group activity.

The shifting of emphasis from the individual to the group, which is involved in collectivism, logically involves a shifting of responsibility for action. This can be made, it would appear, an interesting test of the validity of the theory. For instance, the individual killing of one man by another we term murder. But collective and wholesale killing, we dignify by the name of war, and we specifically absolve the individual from the consequences of any acts which are committed under the orders of a superior officer. This appears to work admirably so long as the results of the action do not take place on a plane on which they can be observed; but immediately they do, the theory obviously breaks down. There may be, ex-hypothesi, no moral guilt attributable to the individual who goes to war; but the effect of intercepting the line of flight of a high-speed bullet will be found to be exactly the same whether it is fired by a national or a private opponent. Nations are alleged to have waged the first world war, but the casualties both of life and property fell upon individuals. There is no such thing as an effective national responsibility—it is a pure abstraction, under cover of which, oppression and tyranny to individuals, which would not be tolerated if inflicted by a personal ruler, escape effective criticism.

We do not know what is the automatic reaction consequent on the killing of one individual by another, as distinct from the non-automatic and artificial reaction involved in the trial and punishment of a murderer in a court of law. But we do know that over every plane of action with which we are acquainted, action and reaction are equal, opposite, and wholly automatic. Consequently, there is nothing to indicate that the automatic consequences of a given action will exhibit any difference if committed under the orders of a superior officer, or not. Further, it may be observed that non-automatic “punishment” really constitutes a separate group of actions and reactions.

If we throw a stone into a still pool of water, the ripples which result are not eliminated by throwing in a second stone, although they may be masked, and to the extent that legal punishments represent, not the ripples from the first stone, but the casting of the second, it will be seen that a complicated situation is inevitable.

CHAPTER IV

The consequences of the exaltation of the group over the individual have often been pointed out in various forms of words, as well as having been demonstrated sufficiently in such countries as Russia and Germany, but it would be unduly optimistic to say that they are generally recognised or understood. And the reason for this is not far to seek. It is possible so to twist the meaning of words, that policies which result in conditions which are progressively obnoxious to the majority of persons affected by them, can yet obtain a considerable amount of support, by an appeal to high-sounding words such as democracy, justice, and equality. The emotion to which appeal is made, is that which was invoked to justify witch-burning. The point which is so hard to make clear to the masses affected, is that a group is an entity which has a life of its own; it is the body corporate of an “interest,” not of the myriad interests of the human units composing it, and the surrender of volition to a group means, quite inevitably, a surrender of the very things for which in most instances the individual is struggling. Yet this body cannot be kicked, nor can the group-soul be saved, save in the persons of the individuals who lend themselves to its purposes. Even the leaders of a group are only leaders so long as they serve the interests of the group, and to that extent are as much slaves of it, as the humblest member of the rank and file; a fact which it is well to bear in mind when attributing to captains of industry qualities which belong rather to their office than to the individuals themselves. It is, of course, true that “head” or supervising slaves are generally strong supporters of slavery as an institution.

And yet it is patent that the modern world can only be operated through a liberal use of the group idea. If we are to have great co-operative undertakings, by which alone, so far as we are aware, mankind can be freed from the necessity of devoting the major portion of his day to the acquisition of sufficient food, clothing, and shelter from the weather, there must be a submission by those concerned in such enterprises to a given policy, for instance, of production. This is, of course, common sense, and a matter of common observation, and to the extent that there is a legitimate relation between the group interest thus formed, and the personal interests, is sound in every way. But there are two qualifications which can be made in respect of this submission. The first of these is, in plain English, bound up with the length of time per day or per year during which the submission is necessary, and it has already been observed that the free play of modern science and organisation would, under certain circumstances, tend to reduce this to a small minimum within a short time. The second qualification is involved in the phrase “freedom of association.”

At the present time such a thing can hardly be said to exist outside the realms of sport. If I join a cricket club and find that I do not like the game, or the methods governing the conduct of the club itself, I am usually free to resign without further penalty than attaches to the loss of association, and the consequent facilities for playing cricket. But if I enter a profession or business and find that I do not like it, or the methods under which it is conducted, it is true that I am free to resign, but the penalty attached to resignation greatly exceeds the mere deprivation of association and the facilities to exercise the profession or business—it includes economic catastrophe for myself and my family. In other words, I come up against the doctrine of rewards and punishments in an acute form, since it is absurd to suggest that if I resign, the necessary work previously done by me will remain undone. It will not, if it is tolerable work and done under tolerable conditions. An average consequence is that I do not either resign from, or criticise actively, my associations of this nature. In passing, it may be noticed that only recently has the absurdity of the “right to strike,” as exercised under current financial methods, dawned upon the Labour Party and its constituents. Where one party to a controversy can only obtain the means of subsistence by “working” while the other party can continue, if not indefinitely, for a long time, by drawing cheques on institutions which, if necessary, can create their own deposits, the right to refrain from working merely amounts to a right to commit suicide. The decline of the practice of Hara-Kiri in Japan, as a means of inflicting injury on an adversary, would tend to show that suicide is losing its terrors for the onlooker.

There is probably more nonsense spoken and written around the words freedom and liberty, than in regard to any other two words in the English language. As a result of this, we have been treated to a dissertation by Signor Mussolini, suggesting that liberty is an outworn and discredited word. Signor Mussolini is mistaken. Liberty will come into its own, although it is quite possible that two groups which appear to be enemies of it and have much in common, including quite possibly, a similar origin, i.e. Bolshevism and Fascism, may be necessary to clear the minds of the public of much of the misconception which surrounds the idea, by demonstrating what it is not.

Liberty is really a simple thing, although difficult to come by. It consists in freedom to choose or refuse one thing at a time. It is undeniable that every action has consequences. But by no means all the consequences of actions, as committed in everyday life, are necessary consequences. If I drive a motor-car at forty miles an hour on an open road, it is an artificial consequence if I am fined for exceeding the speed limit, though a natural consequence that I arrive at my destination quicker than if I drove at twenty miles an hour. If I pick up a red-hot bar, it is not necessary that I should be burnt. I can wear asbestos gloves. It is the hedging round of actions with conditions or “laws” of various descriptions so as to produce an artificial or undesired train of consequences, which constitutes an infringement of liberty, and in a large number of cases, just as it is the Law which makes the Crime, it is stupidity which conceives the law.

If I say that, being a golfer, I wish to play golf all day, seven days a week, I am in effect demanding freedom from certain limitations which are normally imposed on me, such as the earning of a living, not to mention other social duties. Now the abstract criticism which is nearly always urged in connection with a hypothetical case of this sort is, that if everyone played golf all day seven days a week, the world would come to a standstill for want of the necessaries of life. But this line of approach is both fallacious and useless. The useful line of approach is to consider how many people if free to do it, want to do this thing to this extent, and what effect that number would have on the production programme. And the possibility of an increase in the real liberty of the subject depends not (as is so unceasingly proclaimed by the upholders of things as they are) in a continual compromise between individual rights, but in a continual attempt to remove limitations which are non-automatic, that is to say, do not proceed from what we call the laws of nature. It must be confessed that a consideration of our machinery for putting regulations on the statute book, does not lead to any great optimism at the moment in this regard.

It is in the method of attack on its problems, that modern inductive science offers such a striking lesson to politics and legislation; in recognising the existence of certain forces in the universe which have real validity, and that in consequence its triumphs must be achieved by ascertaining the nature of these forces and, taking them as they are, employing and combining them to achieve the desired result. But the whole of our modern civilisation is hedged in, distorted, and confused by a number of limitations which have no validity other than that which we choose to give them. Let anyone who may doubt this statement, and its profound significance, take up a daily paper and consider the suggestions of correspondents and leader-writers in regard to any situation which may at the moment be engaging attention. Has there been a motor accident? Then a new law must be passed imposing fresh restrictions on the use of motor-cars. Has there been a strike in the East End? Laws should be passed to make striking illegal. The joint phenomena of several millions of unemployed and under-employed, capable of road building, and willing to work, and the fact that 95 per cent of the motor-car accidents which occur are traceable to avoidable congestion of traffic and out-of-date roads, is apt to be the very last thing which is pointed out in relation to the first-mentioned problem; and the fact that the actual amount of goods which would be bought by the extra money necessary to keep the East End strikers at work, is trivial in comparison with the quantity available, is never even mentioned in regard to the second.

It should not be, but probably is, necessary, at this point, to observe that it would be fantastic and impracticable to destroy the whole fabric of legalism at one blow. There is a great deal of work to be done in deciding the nature and relation of physical and psychological limitations before anything so drastic is possible. But it is possible to recognise and to work towards the objective; and, moreover, it is urgent. Especially in America, legalism is becoming an obsession. Yet non-automatic laws rest upon a very insecure foundation. When we see, as we do, statements in leading European and American journals to the effect that civilisation is tottering, it may be inferred without much difficulty that it is this fabric of non-automatic rules and regulations which seems to the writers to be in danger. The laws which govern the combination of oxygen and hydrogen, or the rate of acceleration of a stone dropped over a cliff, are never seriously endangered by any of the events to which so much importance is attached in Wall Street and Lombard Street.

This being so, the picture presented to the mind of any thoughtful observer must be that of a bridge which has been reared through the agency of scaffolding and false-work. Its completion has been delayed and its lines obscured by the failure to remove the structure which has enabled it to be built, but which is no longer necessary. The people of the world are clamouring for admission and many of them are supported by the false-work. The problem is to get the false-work away without precipitating into a catastrophe the swarming multitudes who regard it as the real structure. Unfortunately, a number of the foremen working on the bridge seem themselves unable or unwilling to distinguish the structure from the scaffolding.

CHAPTER V

A conception which is closely connected with the theory of rewards and punishments, is that of “Value.” In effect, value may be defined, to fit the orthodox conception of it, as that quality which gives to anything maximum exchangeability under present conditions. Rewards and Punishments, Justice, i.e. the assessments of desserts, and “Value,” i.e. the basis on which desserts are assessed, may be said to be the corner stones of the Semitic structure of society.

Now, so far as this attribute called “value” can be said to have any basis in the nature of things, it consists in that quality which renders a given object serviceable in the attainment of a given end. But it will be found on consideration that this definition is eventually antagonistic to the more orthodox description of the quality previously given. For instance, if it is necessary for me to cross a large river, a boat would seem to be my immediate requirement. Its utilitarian value to me consists in its ability to transport me across the river with a minimum of inconvenience and a maximum of speed. But the generally accepted opinion of its value would be directly proportional to my ability or the ability of someone else, to submit to penalisation financially for the use of the boat, and this again would be directly proportional to the urgency of my need and would be enhanced by the absence of other boats. It should be particularly noticed that this kind of value is not inherent—it is one remove away from the simple usefulness of the boat.

As a result of this conflict of ideas and consequently of objectives, the value of anything which has a use is, according to the popular idea, enhanced by its scarcity, and it is quite fair and unimpeachably logical that a world which seeks after “values” should proceed to create them through the agency of scarcity.

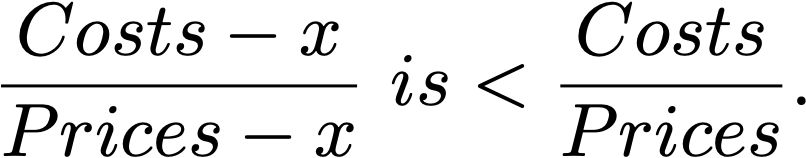

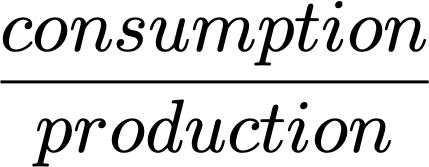

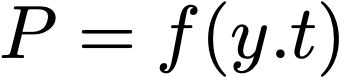

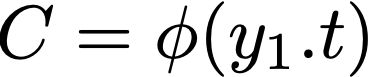

It is not only logical, but what is more important, it is what happens. The process of creating “Values” by creating a demand which is in excess of the supply, is called advertisement, and by restricting a supply so that it is always less than the demand, is technically known as Sabotage. Advertisement has its exposition on every hoarding; Sabotage is its commercial complement, and is one of the most widespread features of our existing civilisation, and yet one which on the whole passes unnoticed, in anything like its true proportions, by the general public. It is not confined to any one class of business or profession, although its cruder manifestations, as might be expected, are found amongst the less fortunately placed masses of the people. It is, of course, the only theory, if it can be so called, underlying the strike, the assumption being that if the whole of the available labour can be taken off the market the financial value of it immediately increases. The higher manifestations of it are slightly more subtle but identical in principle. The modern objective of big business is to obtain the maximum amount of money for the minimum amount of goods. Or to put it more accurately, to obtain a maximum total price for a minimum total cost. As a result of this, business acumen is measured by the ability to create price rings in indispensable goods, while decreasing the purchasing power or “costs,” distributed during their manufacture and storage.

The theory underlying both advertisement and Sabotage, together with their results, has been treated at some length elsewhere.[1] An important aspect of the latter, however, which will perhaps bear explanation at this time, is concerned with the financial policy of nations.

When we say that the objective of modern business is to obtain a maximum total price for a minimum total cost, we are implying in the case of a given undertaking that the receipts shall be at least equal to the disbursements, and in addition that the surplus of receipts shall be as large as possible. This is the same thing as saying that all the costs of an article shall be included in the price of it to the public. In the case of a nation, as at present situated, all the alleged services which it renders to the public composing it are supposed to be paid for eventually by taxes, and the objective of every orthodox government is to balance its budget, and to repay its “borrowings.” That is to say, to make its receipts in taxation equal or exceed its expenditure, and in addition to have as large a surplus as possible with which to pay the interest on loans created by the financial hierarchy and to “sustain the nation’s credit” in view of future loans.

When, later, we come to examine the mechanism of money and the sources from which it originates, it will be seen that this is not in any fundamental sense necessary, but for the moment it is only requisite to point out that the result is to create a shortage of money in the hands of the general public, and in consequence to enhance its scarcity value. If we can conceive, what is in fact the case under the existing financial system, that money is a commodity in exactly the same sense as is tea or sugar, and that there is a powerful, if unobtrusive business ring which deals in money as a commodity, it will be readily understood that the balancing of budgets and the repayment of loans by taxation is a prime interest of those interested in the commodity. Money dealers are normally deflationists.

As no government can carry on for a month without money, it is not necessary to labour the point that the visible government of a country is obliged to take its orders and to shape its policy, and particularly its financial policy, in accordance with the instructions of the dealers in this indispensable implement, so long as they hold a practical monopoly of it.

Just as the artificial theory of rewards and punishments is a distorted reflection of the automatic process of cause and effect, and the orthodox idea of value has possibly its root in something which may be described as suitability, so, that questionable abstraction to which we refer under the name of justice may have a groundwork in the nature of things. One instance of this, and an instance having immense importance at the present time, is contained in the theory of “cultural heritage.”

The early Victorian political economists agreed in ascribing all “values” to three essentials: land, labour, and capital. Without staying at the moment to discuss the unsatisfactory meanings which were frequently attached to these words, we may notice that, the three together being defined as the source of all wealth, the possession of one or the other of them seemed logically defensible as a claim, and collectively, the only valid claim to the wealth produced. But it is rapidly receiving recognition that, while there might be a rough truth in this argument during the centuries prior to the industrial revolution consequent on the inventive period following the Renaissance, and culminating in the steam engine, the spinning-jenny, and so forth, there is now a fourth factor in wealth production, the multiplying power of which far exceeds that of the other three, which may be expressed in the words of Mr. Thorstein Veblen[2] (although he does not appear to have grasped its full implication) as the “progress of the industrial arts.” Quite clearly, no one person can be said to have a monopoly share in this; it is the legacy of countless numbers of men and women, many of whose names are forgotten and the majority of whom are dead. And since it is a cultural legacy, it seems difficult to deny that the general community, as a whole, and not by any qualification of land, labour, or capital, are the proper legatees. But if the ownership of wealth produced vests in the owners of the factors contributed to its production, and the owners of the legacy of the industrial arts are the general community, it seems equally difficult to deny that the chief owners, and rightful beneficiaries of the modern productive system, can be shown to be the individuals composing the community, as such.

Now it is indisputable that a solution of the more immediately pressing problems with which civilisation is confronted at the present time, does in fact turn on the removal of the limitations to the distribution of wealth (which limitations also react on its production). So that in this case, and no doubt in many others, it is possible to make out a theoretical case for a line of action which is also justifiable by expediency. But the great danger of placing too much reliance on the deductive method, is that the whole of its conclusions are rendered misleading and dangerous if an essential factor is omitted from the premises.

|

“Economic Democracy.” |

|

“The Engineers and the Price System.” |

CHAPTER VI

In dealing with the subject of Values in its human aspect, many points of practical importance arise. One of these can probably best be seen in correct perspective, by an examination of common human motives. It is involved in the complaint against the modern co-operative industrial system, that its routine operations are soul killing, monotonous, and without interest, and that a remedy can be found, and can only be found in a return to handicraft.

A good deal of the criticism which has proceeded from “Intellectuals,” concerned, and rightly concerned, with the desperate defects of contemporary society, has been directed to stress this point. It is an aspect of modern industrialism which lends itself to picturesque treatment and sentimentalism, and probably the exploitation of it offers more emotional reward to the would-be reformer, and obtains wider acquiescence from his public, than is the case with the more mechanical aspects of the same problem.

While it may be necessary, for these and other reasons, to suspect over-emphasis, there are solid grounds for the complaint, and it is well worth examination.

In so doing, we may employ a conception which will be familiar to students of Eastern Philosophy, which regards the world, or society, as a macrocosm or “Great Man,” reflecting on a gigantic scale the microcosm or individual man. In this conception every attribute of the human individual is repeated on a mighty scale in the “World Man,” and, to this World Man, the “Prince of this World,” the human individual bears very much the same relation that the blood corpuscle of the individual does to the human body. It is no part of the purpose of this book to offer any opinion as to the extent to which this conception has any basis in absolute truth, but it is undeniable that it does form a convenient basis in estimating the probable success of any suggested set of human relationships.

Now the interest of the blood corpuscle, if it can be imagined to have an interest, is only concerned with the body of which it is a constituent in so far as the continued existence of that body tends towards its own progressive evolution, and the interest of the human individual in society is similar. Any other conception, besides being pharisaical and sentimental, is an invitation to all those influences which stand ready to exploit the individual under cover of such phrases as Public Interest and National Duty. But it is equally true, so far as we can see, that the expansion of the human unit is dependent upon the progress of society. That is to say, upon environment. Virtue may flourish in the gutter, but if Virtue can only flourish in the gutter, as some people would have us believe, then it is time that the nature of Virtue received severe scrutiny. If these relationships be admitted, at any rate for the purpose of a working hypothesis, it seems to follow that the human individual has two aspects, one of which is functional, and specialised, and is only concerned with the health and well-being of the “Great Man,” i.e. Society, of which he forms a part. Out of this aspect, he benefits indirectly, not directly. This is exactly the position of the individual in regard to the division of labour which forms the basis of co-operative industrialism. To proceed with our chosen analogy, the individual can, in the nature of things, only form a constituent of one function of the Great Man, at any one instant of time. There is nothing to prevent his forming a constituent of another function at a subsequent period of time. There seems to be nothing inherently absurd in a man being a bricklayer in the morning, and a Company Director in the afternoon, and, in fact, there are good grounds for imagining that something of this sort may come to pass. But the point it is desired to stress at the present moment, is that, in this aspect, the individual is not serving his individuality, but ought to be serving his environment in the best way possible, and direct artistic gratification from work performed in this way is neither specifically to be looked for, nor is it the immediate object of the work. It may even be the cause of a narrow outlook.

Whether society as a whole can be imagined to have an individuality of its own or not, it may be repeated that Society’s individuality is not a prime interest of the human individual. It is an auxiliary interest, and may even be a perversive interest. It is most probably true that there can be no divergence between true Public Interest and any true private interest; if it were so, words would have lost their meaning; but it is certain that no crushing of individuality by Society can ever conduce to the well-being of other individuals. The human individual, under the same conception, contains either in a latent or active form, every function and attribute, although on a minute scale, which can be imagined to reside in a world society. Consequently, although work for its own sake, or employment as an end and not a means, is objectionable when it is purely functional, or to put the matter in everyday terms, since it is plainly desirable to cut down the amount of time necessary to improve the general environment at whatever rate is deemed desirable, work for its own sake may quite easily be essential to the well-being of the individual. The difference is subtle, but it is vital. To knit a jumper or to dig and plough because of the satisfaction of knitting a jumper or of creating a garden or a wheatfield, or even because it is healthy, is one thing, and it may happen as a by-product that the jumper or the wheatfield will be superlatively well done; to knit jumpers, or to dig and plough ten hours a day, six days a week, fifty-two weeks a year, because unless this is done the mere necessities of existence cannot be obtained, is quite another. To dress neatly, comfortably, and suitably, taking half an hour over the process, seems reasonable; to spend the day in dressing is monomania—our forbears called it “possession.” When we do things under the compulsion of Society, we are blood-corpuscles, not individuals; we are doing them in the interests of Society primarily, and only secondarily, if at all, in the interests of our own individuality. As society is at present constituted, it is quite definitely to its advantage, and tends to the perpetuation of the present form of Society, that Lancashire mill operatives should work the maximum number of hours at a very dull occupation, with the minimum of change of work, and if individuals had no interests as such, that is to say, if they were Robots, contemporary society would probably work very well, and no difficulties would arise. But Lancashire mill operatives are developing individualities, and their interests are clearly not the same as those of Society as at present constructed. In one way or another the various units which compose the Society are proclaiming unmistakably their objection to a purely passive role, and the conflict which we see proceeding all over the world at the present time will clearly determine whether Society has power to remould the individual so that he becomes purely a passive agent in respect of purposes which he cannot understand, and has no means of estimating, or, on the other hand, whether the individual by non-co-operation or otherwise, can break up or remould Society. For my own part I have small doubt as to the outcome.

CHAPTER VII

Out of the two conceptions of abstract justice and abstract value, arises an important misdirection of thought in connection with a subject with which we shall become more and more concerned as we proceed; the subject of Money. There are few people who would claim that the money systems of the world are perfect, and the number of such persons is decreasing daily. But when asked to define the various defects in the money system, it is remarkable to notice with what monotonous regularity these ideas of “justice” and “value” are paraded. It is claimed that money is defective because it is not an accurate measure of value, or that it results in an unjust “reward” for labour, but when such critics are asked to suggest a method by which the relative value of a sunset, and say, the Venus di Milo might be assessed, on the one hand, or, on the other hand, what is the “just” return for a given amount or variety of labour, their answers are not usually helpful from a practical point of view. Reams of paper and many valuable years have been expended in endeavouring to define and standardise this thing called “Value,” and with it, the methods of relating goods and services to the standard when obtained. The line of thought which is usually followed, is something after this fashion.

“Money is a standard or measure of value. The first requisite of a standard or measure is that it shall be invariable. The money system is not giving satisfaction, money is not invariable, therefore, the problem is to standardise the unit of money.” As a consequence of this line of argument, a dazed world is confronted with proposals for compensated dollars varying from time to time in the amount of gold they contain in accordance with the price index, or even with card money out of which holes are punched to represent its adjustment to the physical realities of economics. Nor is the misdirection of thought confined to professional economists. Almost the first idea which seems to present itself to physical scientists whose attention is directed to this problem, is in the nature of a search for some adaptation to finance of the centimetre-gramme-second system of units. Yet perhaps the most important fundamental idea which can be conveyed at this time, in regard to the money problem—an idea on the validity of which certainly stands or falls, anything I have to say on the subject—is that it is not a problem of value-measurement. The proper function of a money system is to furnish the information necessary to direct the production and distribution of goods and services. It is, or should be, an “order” system, not a “reward” system. It is essentially a mechanism of administration, subservient to policy, and it is because it is superior to all other mechanisms of administration, that the money control of the world is so immensely important.

The analogy of the “Limited” railway ticket is for all practical purposes exact, a railway ticket being a limited form of money. The fact that a railway ticket has money-value attached to it is subsidiary and irrelevant to its main function, which is to distribute transportation. A demand for a railway ticket furnishes to the railway management a perfect indication (subject, at present, to financial limitations) of the transportation which is required. It enables the programme of transportation to be drawn up, and the availability of a ticket issued in relation to this programme enables the railway traveller to make his plans in the knowledge, that the transportation that he desires will probably be forthcoming. It is every whit as sensible to argue that because there may only happen to be one hundred tickets from London to Edinburgh in existence, that, therefore, no more than one hundred passengers may travel, as it is to argue that because the units of money happen at the moment to be insufficient (whether they are “invariable” or not), therefore, desirable things cannot be done, irrespective of the presence of the men and the materials necessary to do them. The argument only assumes validity if a deficiency of tickets is a reflection of a real deficiency in transport, and not vice versa.

The measurement of productive capacity takes place, or should take place, in regions other than those occupied by the ticket office, or its financial equivalent, the bank, and the proper business of the ticket department and the bank is to facilitate the distribution of the product in accordance with the desires of the public and to transmit the indication of those desires to those operating the industrial organisation, to whom is committed the task of meeting them. They have no valid right to any voice in deciding either the qualifications of travellers, or the conditions under which they travel.

It will no doubt be observed that there is a close connection between the point of view which it is here suggested is vital to a solution, and the contrast indicated in the opening chapter of this book, between the Classical and the Modern system of education. Just so long as a rigid abstraction is made the test to which physical facts must conform (and any theory of money which pretends to measure values comes under this description), just so long must there be friction and abrasion between the theory and the facts (and facts are much harder than theories). Dissatisfaction and disappointment in the world as a result, can be predicted with certainty. In other words, Utopia is—Utopia. It has been said before, but it will bear repetition. The picture and specification of the world people desire at the present time, is, like the kingdom of heaven, within each one of them, and their desires in general are not more likely to be satisfied by a card-indexed Paradise after the heart of Mr. Stalin, than by an Imperialistic millennium ruled by Mr. Kipling’s “Aerial Board of Control.” It is quite arguable that material wealth, with the emancipation it can carry with it, will not bring happiness, but it is not arguable that the vast majority of people will take this truth, if it is truth, on hearsay. It is as probable that a starving man will listen patiently to a lecture on gluttony.

CHAPTER VIII

It has perhaps by now become possible to obtain some sort of mental picture of the policy controlling the world in which we live, and having done this it should be easier to make some comparison of this policy with one to which more general acquiescence might be obtained. It must be recognised that the great elementary human emotions, desire and fear, are employed with great skill by the Invisible Government, in the guise of rewards and punishments, to obtain certain results. These results, it would appear, might not have been obtained, had not a large majority of the world’s population been cajoled or forced into doing a great deal of work which momentary necessity did not, in point of fact, render inevitable. In this way have been produced enormous reserves of real capital, by which is meant plant, buildings, tools, and still more important, the knowledge, organisation, and processes necessary to their application; and only by this building up of capital, it would seem, has further progress become possible. In the earlier centuries of the present era, even war seems to have been justifiable in a broad sense, both as an elimination test, and as a stimulant to invention and initiative. It is also difficult to conceive of any plan by which the possible advantage of the individual could have been advanced so rapidly, as by his temporary submergence in large groups, to which we give the name of nations or races. All this may be admitted as being applicable to within comparatively recent years, let us say to the middle of the last century, just as we may often be prepared to admit that a statesman who, under post-war conditions has become a hindrance to progress, rendered vital service under circumstances suitable to his talents.

But because a thing was once sound and desirable, it is by no means necessary to admit that it is permanently advantageous. Largely because of the progress in the industrial arts, but not less as the result of a general spread of education, a system of world organisation which is based on the deception of the general public, the practical necessity or expediency which might perhaps be excused in the past, has now become both undesirable and actively and practically vicious.

The reaction of a threat on the highly-strung human product of modern civilisation is dissimilar from that which was obtained a few hundred years ago. War has become definitely dysgenic. So far from killing off the weakling and the slow-minded, it has a strong tendency to remove these, together with the shirker, to a point distant from the field of conflict, and in many cases to place them in a position of subsequent advantage both financially and otherwise, as compared with bolder and more enterprising compatriots. And human intelligence has progressed to the extent that a method of stimulating industry similar to the holding of a carrot continuously in front of a donkey’s nose to produce progress, has ceased to function effectively. Even an ass has a rudimentary sense of proportion between miles walked and carrots achieved. If the principal objective to which humanity might reasonably be directed, were the same as that existing five hundred years ago, it is nevertheless clear from the general unrest, that the methods by which general co-operation can be obtained require considerable and early modification. But this objective is not the same.

It seems indisputable that the maintenance of a unit of human life involves a process of metabolism, or, in other words, the breaking down and building up of form through the application of energy. When men maintained themselves by manual labour, this process was very nearly a closed cycle, that is to say, it took a large portion of the energy which mankind acquired through food, to maintain life. There is inductive support for this line of thought in the consideration of such civilisations as those of India and Persia, which were at a substantially similar stage less than one hundred years ago, to that which they had reached three or more thousand years ago. Even to-day, there are thousands of square miles in the Middle and Far East, in which both the habits of thought, and manner of life, are indistinguishable from those recorded in the earliest literature with which we are acquainted. The cycle was, in all probability, not quite closed, or under the law of the conservation of energy, which can be assumed to apply in some form, no progress would have been possible; and it is reasonable to argue that the slight increment of energy which permitted the upward spiral of evolution, was derived by direct absorption of the energy of the sun’s rays.

But the inductive or experimental method of attack on the problems of life which may be said to be the outstanding feature of the Renaissance in the West, resulted in a profound disturbance of the premises of human existence. From the moment that the first crude steam engine pumped the first gallon of water, if not before, the metabolic cycle contained a factor, a new method of entrance for solar energy, which was bound to result in a much steeper spiral of ascent. And at the present time it seems reasonable to believe that we have reached a point at which we are within sight of a considerable release of human energy from the mechanical drudgery of existence by toil.

The outcome of this must surely be obvious. So far from the mere sustenance of life through the production of food, clothing, and shelter from the elements being, with reason, the prime objective of human endeavour, it should now be possible to relegate it to the position of a semi-automatic process. Biologists tell us that the earliest known forms of life devoted practically the whole of their attention to the business of breathing. Breathing is not less necessary now than it was then, but only persons suffering from some lamentable disease pay much attention to the process.

It is not relevant to the purposes of this book to indicate the new objective to which human energy will in all probability redirect itself. It is merely intended to suggest the possibility of the re-orientation, and the methods by which at the moment it is being hindered, in order that those hindrances may be removed.

Now it is quite probable that a recognition of the truth of the foregoing ideas, although not formulated, underlies a great deal of the opposition to any sort of reform, on the part of the more favourably situated individuals in society. These persons recognise that they have, in their fortunate position, something worth retaining. Whether a satisfactory use is always made of the opportunity which is theirs, is for the moment, outside the argument. Until recently, every proposal for a change has attacked their position. They have replied, and with reason, that they have just as much, or if it be preferred, as little claim to consideration as those persons who have attacked them, and, in any case, there they are, and there they mean to stay. This incidentally demonstrates the futility of abstract justice when in opposition to the solid facts of life.